Tiered Copays: Why Your Generic Medication Might Cost More Than Expected

Dec, 3 2025

Dec, 3 2025

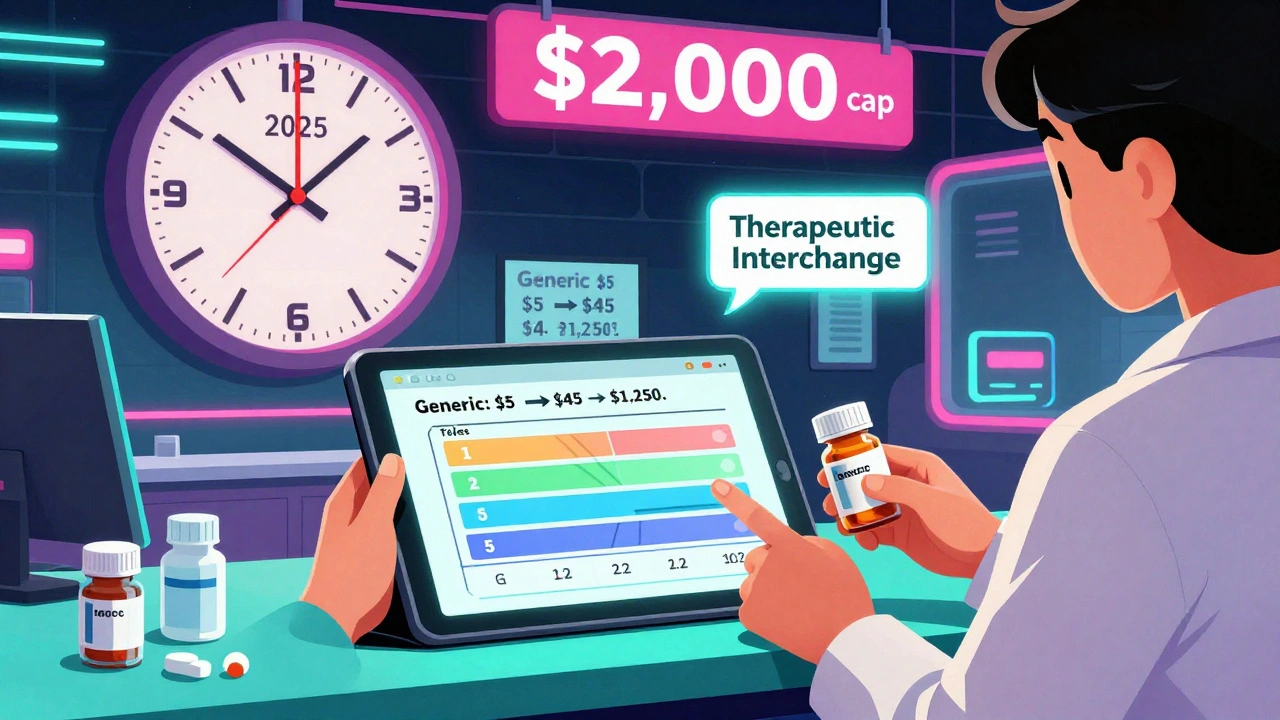

It’s 2025, and you pick up your levothyroxine prescription at the pharmacy. Last month, it cost $5. Today, it’s $45. You’re confused. You thought generic meant cheap. You ask the pharmacist. They shrug. Your doctor says all generics are the same. So why the spike?

This isn’t a mistake. It’s the system.

Most health plans today use something called a tired copay system-a structure that sorts your medications into tiers, each with its own price tag. Tier 1 is for the cheapest drugs. Tier 5 is for the most expensive ones. You’d assume all generics land in Tier 1. But that’s not always true. In fact, nearly one in five generic drugs are stuck in higher tiers, even when they’re chemically identical to the cheaper version.

How Tiered Copays Actually Work

Think of your drug plan like a grocery store with different pricing zones. Tier 1 is the clearance aisle: preferred generics like metformin or atorvastatin, often $0-$15. Tier 2 is the regular shelf: preferred brand-name drugs, maybe $25-$50. Tier 3? That’s where things get weird. You’ll find non-preferred brands here-drugs that work just fine but cost more because the manufacturer didn’t give the pharmacy benefit manager (PBM) a big enough discount.

But here’s the twist: some generics live in Tier 3 too.

Why? Because it’s not about the drug. It’s about the deal.

PBMs like CVS Caremark, Express Scripts, and OptumRx negotiate rebates with drugmakers. If a generic manufacturer offers a bigger rebate, their version gets placed in Tier 1. If another generic-identical in ingredients, dosage, and effect-doesn’t offer the same deal? It gets pushed to Tier 2 or even Tier 3. The result? You pay more for the exact same medicine.

According to 2023 data from BOC Pharmacy Group, 12-18% of generic medications are classified as specialty drugs, meaning they’re placed in Tier 4 or 5. That’s not because they’re complex or risky. It’s because they cost more than $600 a month to make. Even if they’re generics.

Why Your Generic Isn’t Always the Cheapest Option

Let’s say you take a generic version of lisinopril for high blood pressure. Your plan used to cover it for $5. Now it’s $20. You check your formulary online. You see two lisinopril generics listed. One is Tier 1. The other is Tier 2. Same chemical. Same manufacturer. Same pill. But one costs four times more.

This isn’t rare. A 2023 Patient Advocate Foundation survey found that 41% of insured adults had experienced this exact scenario. And 68% couldn’t get a clear answer from their insurer.

The reason? Rebate contracts expire. A drugmaker might have offered a sweet deal last year. This year, they didn’t renew it. So the PBM moves that generic to a higher tier. No warning. No clinical reason. Just a business decision.

Dr. Dennis G. Smith, former director of the Center for Medicaid and CHIP Services, put it bluntly: “Preferred status has nothing to do with clinical superiority-it’s entirely about the rebates and discounts PBMs negotiate with manufacturers.”

That means your doctor’s prescription isn’t the deciding factor. Your insurer’s contract is.

Specialty Generics: When a Generic Costs Thousands

Some of the most confusing cases involve specialty generics-drugs that used to be biologics but now have generic versions. Think adalimumab (Humira), used for rheumatoid arthritis. The brand version cost over $2,000 a month. Now, the generic is available. But it’s not in Tier 1. It’s in Tier 4 or 5.

Why? Because even though it’s generic, it still costs $5,000-$10,000 a month to produce. Insurers don’t treat it like a $10 pill. They treat it like a specialty drug. That means you pay 25-40% coinsurance. So even though you’re getting a generic, your monthly bill could still be $1,250-$4,000.

And here’s the kicker: your pharmacist might switch you to a different generic without telling you. That’s called a “therapeutic interchange.” It’s legal. But if the new version isn’t covered as well, you’re stuck paying more.

What You Can Do About It

You’re not powerless. There are steps you can take.

1. Check your formulary every year. Medicare plans update theirs on October 1. Employer plans often change in January. Don’t assume your drug is still in the same tier. Use your insurer’s online tool-Humana’s Drug Cost Lookup, or Cigna’s formulary search. Or try GoodRx or SmithRx’s tier comparison tool.

2. Ask your pharmacist to check for alternatives. If your drug jumped tiers, ask: “Is there another generic version of this that’s cheaper?” Often, there is. Pharmacists can help you switch to the Tier 1 version without a new prescription.

3. Request a therapeutic interchange form. If your doctor agrees, they can fill out a form asking your insurer to cover your current drug at a lower tier. According to the Medicare Rights Center, this works 63% of the time.

4. Look into manufacturer assistance programs. Many drugmakers offer copay cards or free medication programs for eligible patients. In 2023, these programs covered 22% of specialty drug costs for people who qualified.

5. File an exception or appeal. If your drug was moved to a higher tier mid-year and you’re stable on it, you can appeal. Most plans require you to act within 72 hours for urgent cases. You’ll need a letter from your doctor explaining why switching could harm your health.

What’s Changing in 2025 and Beyond

The Inflation Reduction Act kicks in fully in 2025. For Medicare Part D enrollees, your out-of-pocket drug costs will be capped at $2,000 a year. That’s huge. But here’s the catch: tiered systems are still in place. The cap doesn’t change how drugs are sorted-it just limits how much you pay at the end of the year.

Meanwhile, PBMs are pushing more generics into higher tiers. In early 2024, Express Scripts moved 87 generic drugs to higher tiers because rebate deals expired. UnitedHealthcare started offering $0 copays on high-volume generics like atorvastatin, but only if you take their preferred version.

Experts predict tiered systems won’t disappear. But they’ll get simpler. By 2026, most plans may shrink from five tiers to four. The goal? Reduce confusion while still steering patients toward cheaper drugs.

But here’s the real question: should a generic drug ever cost more than the brand? If two pills are identical, why should you pay more for one?

For now, the answer is: because the system lets them.

What This Means for You

You’re not just a patient. You’re a consumer. And your drug plan is a marketplace-with hidden pricing rules.

The system was built to save money. And it did. Studies show tiered copays reduced total drug spending by 8-12% in the early 2000s. But the cost wasn’t just financial. It was trust.

Patients feel betrayed when their $5 pill becomes $45 overnight. Doctors feel powerless. Pharmacists feel caught in the middle.

The fix isn’t simple. But awareness is the first step.

Know your plan. Know your drugs. Ask questions. Push back. And if you’re paying more for a generic that’s identical to a cheaper version-you’re not crazy. You’re just caught in a system designed to save money, not make sense.

Why is my generic drug more expensive than the brand name?

It’s not about the drug-it’s about the deal. Your insurer’s pharmacy benefit manager (PBM) negotiates rebates with drugmakers. If a generic manufacturer offers a bigger discount, their version gets placed in the lowest tier. Another generic, identical in every way, might be in a higher tier simply because the rebate deal expired or wasn’t as strong. The brand name may still be cheaper if the PBM has a better rebate on it than on the generic.

Can my pharmacist switch my generic without telling me?

Yes. This is called a therapeutic interchange. Many plans allow pharmacists to substitute a cheaper generic version-even if your doctor prescribed a different one. But they’re not required to tell you. If you notice a change in your pill’s color, shape, or cost, ask the pharmacist what was dispensed and whether it’s the same as your prescription.

How do I find out what tier my drug is on?

Log into your insurance plan’s website and look for the formulary or drug list. Most plans have a searchable tool where you can type in your medication. You’ll see the tier and your copay. Medicare plans update theirs every October. Employer plans usually update in January. If you can’t find it, call customer service and ask for your plan’s current formulary document.

Are all generics the same, or are some better?

In terms of active ingredients, yes-all FDA-approved generics are required to be bioequivalent to the brand. That means they work the same way. But inactive ingredients (fillers, dyes, coatings) can differ, and some patients report side effects or effectiveness changes when switching. If you notice a difference after a switch, tell your doctor. You may qualify for an exception to keep your original version.

What’s the difference between a copay and coinsurance for generics?

A copay is a fixed amount you pay, like $15. Coinsurance is a percentage of the drug’s total cost. For example, if your drug costs $1,000 and your coinsurance is 30%, you pay $300. Most generics have copays. But specialty generics-even if they’re technically generic-often have coinsurance because they’re so expensive. That’s why a $5,000 monthly generic could cost you $1,500 out of pocket.

Can I appeal if my drug is moved to a higher tier?

Yes. If your drug was moved to a higher tier mid-year and you’re stable on it, you can file an exception request. Your doctor needs to write a letter explaining why switching would harm your health. Most plans require this within 72 hours for urgent cases. The success rate is around 50-60%, especially if your drug is medically necessary and no suitable alternative exists in a lower tier.

Why do some generics cost more than others even if they’re the same drug?

Different manufacturers make the same generic drug. Your insurer’s PBM negotiates separate deals with each one. The manufacturer that offers the biggest rebate gets their version in Tier 1. The others go into higher tiers-even if the pills are identical. It’s not about quality. It’s about who paid the most to be on your plan’s list.

Will the $2,000 out-of-pocket cap in 2025 fix this problem?

No. The $2,000 cap limits how much you pay in a year, but it doesn’t change how drugs are tiered. You’ll still pay more upfront for a higher-tier generic. The cap just means your total annual cost won’t go beyond $2,000, even if your drugs are expensive. It helps with big bills, but not with surprise price hikes at the pharmacy counter.

Next Steps: What to Do Today

If you’re on a generic medication, do this now:

- Check your insurer’s formulary online. Search your drug by name.

- Compare the copay to what you paid last month.

- Ask your pharmacist: “Is this the same generic I got before?”

- If the cost went up and you’re unsure why, call your insurer and ask: “Why is this generic in Tier 3?”

- If you’re paying more than expected, ask your doctor about a therapeutic interchange form.

You don’t have to accept a surprise bill. The system is complicated. But you’re not alone. Millions are dealing with this. And knowledge is your best tool.

Jessica Baydowicz

December 4, 2025 AT 04:26Okay but like… I just got my levothyroxine for $3 and now it’s $38? I thought generics were supposed to be the ‘buy in bulk and save’ aisle? This feels like getting scammed by a vending machine that changes prices while you’re reaching for the snack.

val kendra

December 6, 2025 AT 03:23Been there. My insurer switched my generic metformin to a different manufacturer last year. Same pill, same dose, same expiration. But now I pay $27 instead of $5. No warning. No notice. Just a new receipt and a silent pharmacist shrug. Call your insurer. Ask for the formulary update date. They’ll hide it in fine print.

Joe Lam

December 7, 2025 AT 20:32Oh wow. A regular person actually noticed the system is rigged. Shocking. I assumed only economists and people who read their EOBs understood that PBMs are just middlemen who profit from confusion. You’re not paying for the drug. You’re paying for the negotiation power of a corporation that doesn’t even make it.

Michael Feldstein

December 9, 2025 AT 04:05Hey, I get it’s frustrating-but don’t panic. Your pharmacist can swap you to a cheaper generic version without a new script. Just ask: ‘Is there another version of this in Tier 1?’ Most of the time, there is. And if your doctor’s on board, a therapeutic interchange form can get you back on track. You’ve got more power than you think.

jagdish kumar

December 11, 2025 AT 01:10The system is a mirror. It reflects our collective surrender to bureaucracy. We accept $45 pills because we’ve been taught to trust labels, not logic. The pill doesn’t change. We do.

Libby Rees

December 11, 2025 AT 17:47This is a well-documented issue. The Medicare Part D formulary structure, combined with PBM rebate structures, creates perverse incentives. The FDA mandates bioequivalence, but insurers are not required to reflect that in pricing. Transparency is the first step toward reform.

Dematteo Lasonya

December 13, 2025 AT 07:00I had this happen with my blood pressure med. I switched pharmacies and suddenly it was $40. I asked the pharmacist, ‘Is this the same thing?’ She said yes, but it’s from a different maker. I called my plan. Turned out the old one had a rebate deal. The new one didn’t. Took three calls and a doctor’s note to get it switched back. Worth it.

Gareth Storer

December 15, 2025 AT 02:20So you’re mad because you’re paying $45 for a pill that costs 12 cents to make? Honey, you’re not being exploited-you’re being subsidized. The real scam is that you think this system was ever meant to be fair. It’s a market. And you’re the product.

Pavan Kankala

December 16, 2025 AT 13:59They’re not just moving generics to higher tiers. They’re testing if we’ll pay more for identical pills. This is the first step before they replace all generics with branded versions under new names. Mark my words: by 2027, ‘generic’ will be a marketing term like ‘natural’ or ‘artisan.’

Isabelle Bujold

December 17, 2025 AT 23:38I spent six months researching this after my insulin generic jumped from $15 to $210. Turns out, the PBM signed a deal with one manufacturer to exclude others-even though the FDA says they’re identical. I filed an appeal, got a letter from my endocrinologist, and after 47 days, they reinstated my original tier. But here’s the thing: I had to become a part-time bureaucrat. No one should have to do that to get their medicine. If you’re reading this and you’re paying more than you should, don’t just grit your teeth. Fight. Document everything. Email your insurer. Call your rep. This isn’t just about money-it’s about dignity.

Rachel Bonaparte

December 18, 2025 AT 21:10Let’s be real-this isn’t about PBMs. It’s about the pharmaceutical-industrial complex. The same companies that made Humira cost $7,000 a month are now selling the ‘generic’ version for $5,000. They’re not saving you money. They’re just moving the profit margin from one pocket to another. And you’re the sucker holding the bag. Wake up. This is capitalism with a stethoscope.

Scott van Haastrecht

December 19, 2025 AT 18:46Everyone’s acting like this is new. It’s not. It’s been this way since 2006. The only thing that changed? More people are now aware enough to be angry. The system is designed to make you feel powerless so you don’t challenge it. But here’s the truth: if you don’t know your tier, you’re not a patient-you’re a revenue stream.

Ollie Newland

December 21, 2025 AT 10:20It’s all about the rebate waterfall. PBMs get kickbacks from manufacturers to push certain generics-even if they’re identical. The ‘preferred’ version? It’s the one that paid the most. Your copay? That’s just the tip of the iceberg. The real money’s in the back-end rebates no one sees. That’s why your plan’s ‘savings’ are a myth.

Rebecca Braatz

December 22, 2025 AT 08:31You’re not alone. I’ve helped over 200 people fight this exact thing. Here’s what works: 1) Screen your formulary every October. 2) Ask your pharmacist for the manufacturer name on your pill. 3) Google that name + ‘rebate’ + your insurer. 4) If the cost jumped, call your insurer and say ‘I need a prior authorization for medical necessity.’ Most of the time, they cave. You’ve got rights. Use them.

Benjamin Sedler

December 23, 2025 AT 01:26Wait-so you’re saying generics aren’t always cheaper? That’s just… weird. I mean, if two things are identical, why would one cost more? That’s like buying two identical apples and one costs $10 because the farmer gave the grocery store a better discount. That’s not capitalism. That’s just nonsense. Someone’s getting rich off this. And it’s not you.